Advertisements

Employers in all sectors, regardless of whether they are Emiratis or foreigners, are required to participate in the UAE unemployment insurance scheme. The Ministry of Human Resources and Emiratisation said that Residents of the UAE or foreign employees working in public and private sectors from anywhere in the world must apply from January 01, 2024.

The program was introduced in order to provide employees with a safety net if their employment is revoked. The employees whether they’re Emiratis or foreign workers will get a 3-month cash sum if they lose their job.

Advertisements

To apply for this job loss insurance scheme in the UAE, the employees must have to be registered with the scheme and should be making monthly payments for their insurance premiums.

The last date to apply for this unemployment insurance scheme was June 30, 2024, according to the ministry. After the deadline, a fine is imposed which will be AED 400.

Advertisements

UAE Unemployment Insurance Scheme | Eligibility, Process and Benefits

Advertisements

Also check out: UAE Golden Visa: Benefits, Requirements, Processing Time

According to the Ministry of Strategic Partnership of Dubai insurance, ‘an AED 200 fine will be imposed on an individual who fails to pay the premium amount after the grace period of 90 days, and the policy will be revoked’. This ministry is working in alliance with the insurance pool UAE.

This Unemployment insurance scheme was introduced to facilitate employees in the UAE if their job is lost due to the company’s economic crisis or any other reason. The ministry took 9 insurance companies on board for this matter to pave the way for recently unemployed individuals to tackle the cost of living. The authority described the job loss insurance scheme what it costs and that employees will have to pay some premium amount for it.

This article will provide you with all the information you need regarding this scheme.

Advertisements

UAE Unemployment Insurance Scheme: What Is It?

Advertisements

This job loss insurance scheme was introduced in May 2022 in order to compensate employees in the event of job loss. This initiative was forwarded by the Ministry of Human Resources and Emiratisation to financially support Emiratis or foreign employees by giving them a 3-month salary sum in the event of job loss. Moreover, a deduction was made each month from worker’s salaries for this insurance scheme.

The deadline to apply online for this scheme was June 30, 2024, and employees from public, private, and free zones institutions were required to apply for this scheme as a must.

In What Way Does It Work?

As per the ministry, compensation would be paid for a 3-month salary sum from the termination date to the end of the third month. A settlement of 60% of the employee’s basic salary will be made for three months. However, the amount should also not exceed AED 20,000 per month to cover the insurance.

Who Pays to Cover the Insurance?

The employees pay or fund this job loss insurance scheme to prevent any hefty repercussions. They can pay for this program on a monthly, quarterly, semi-annually, or annual basis. Whereas, VAT (tax) also applies to the insurance policy value.

What is the Cost of This Insurance Coverage?

The Dubai Unemployment Insurance program’s cost coverage is divided into two categories of working classes. The first category is employees who are earning less than or equal to AED 16,000 as a basic salary per month. These individuals are liable to pay AED 5 per month or AED 60 every year for this insurance. The second working class consists of people who are earning more than AED 16,000 as a basic salary per month. These individuals have to pay AED 10 per month or AED 120 per year in lieu of the insurance.

How much will the unemployment insurance scheme pay me if I lose my job?

Under the Unemployment Insurance UAE, the employees who got fired from their jobs will receive a salary sum of their three months’ salary. For the category of workers earning AED 16,000 or less, the Employment Insurance UAE coverage will not exceed more than AED 10,000 per month. On the other hand, for the category of employees who are earning more than AED 16,000 per month, the insurance coverage will not exceed AED 20,000 for the month.

The monthly insurance disbursement is calculated at 60% of the basic salary. This means, if an individual is earning AED 5,000 per month as a basic salary, he will receive 60% of that for a month i.e. AED 3,000 for three months.

I lost my job. How can I receive unemployment compensation?

Employees who lost their jobs can file for claim in order to receive unemployment insurance compensation. They can file their claim through the smart app, the insurance pool’s e-portal, and the call center. The claim must be filed 30 days after the day of becoming unemployed or job loss.

The compensation will be disbursed within 14 days after it has been filed and will cover the claim for 3 months.

What is the eligibility to apply for unemployment insurance?

Advertisements

Eligibility criteria:

- Employees who are working for at least 12 months in the country are eligible to apply for Unemployment Insurance in UAE

- They should have been paying the insurance coverage cost during this period.

- Employees working on a commission basis are also eligible to apply for this insurance scheme.

Advertisements

Ineligibility criteria:

- Insured employees must not have resigned or have been dismissed due to disciplinary actions by the employer.

- Employees who change jobs, leave the UAE, or work abroad are ineligible for application. Such individuals will not receive compensation from this program (if already insured)

Do all UAE-based workers have to apply for this insurance scheme?

Employees who are working legally full-time in the United Arab Emirates must have to apply for this insurance scheme. However, there can be a few cases where residents who are employed do not have to apply for this program as a must. These conditions are:

- Domestic helpers

- Part-time employees

- Investors (Owners of firms)

- Minors (under the age of 18)

- Retired personnel, who are doing any another job and receiving pension from the UAE government

Does the scheme apply to free zone employees?

Since its inception, this insurance program has mandated all employees, both public and private sectors, to enroll in the scheme. Additionally, this also applies to employees working in free zones.

The Ministry of Human Resources & Emiratisation (MOHRE) also affirmed the matter for employees working in free zone areas. Employees in private organizations, including those in free-zone areas not affiliated with MOHRE, are also eligible for this insurance. Such individuals can apply on the ILOE portal by going on the ‘Non-Registered in MOHRE’ option.”

An update on the ILOE (Involuntary Loss of Employment) portal also affirms the eligibility for free zone employees. Eligible workers can also apply for this insurance scheme by downloading and registering on the ILOE Insurance UAE App available on Android and iOS Play stores.

Unemployment Insurance Scheme UAE: How to Apply Online?

According to the official MOHRE website, UAE nationals and residents working in public and private sectors are eligible to apply for this insurance scheme. In order to apply for this program, employees will have to register online on the following portals:

- The Insurance Pool website.

- Al Ansari exchange

- Insurance Pool (iloe) smart application

However, individuals unacquainted with the online methods can also go personally to the following offices to apply for this insurance program.

- Businessmen service centers

- Kiosk machines

- Bank ATMs and applications

- Telecommunication bills

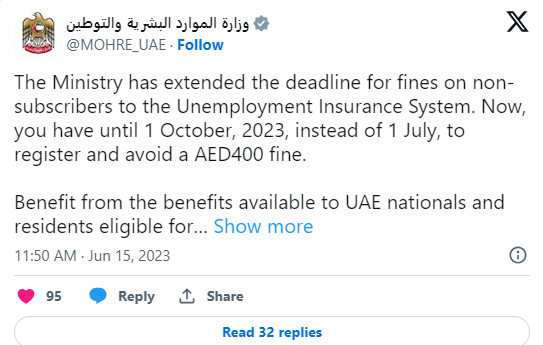

UAE Unemployment Insurance Deadline Extended

Earlier, the deadline to apply for the insurance program was 30 June 2025. The MoHRE UAE extended the online deadline to October 1, 2024, to avoid an AED 400 fine for late submission.

Individuals who haven’t applied up til now for this Job Loss Insurance scheme can now easily apply for it through the methods mentioned above. They can do so by using online or physical procedures to claim or to register themselves for this scheme. Some of these methods include the iloe smart application, Al Ansari Exchange, Kiosk machines, Bank ATMs and applications, etc.

In conclusion, the UAE government offers this facility to provide financial security for those who recently lost their jobs. The government’s action shows how much they care for their residents and citizens. It’s essential for UAE workers to register and pay promptly for insurance to prevent mishaps. Your responsibility, their security.

Advertisements

Everything About Jobs in Gulf – 247EmiratesGuides.com

Everything About Jobs in Gulf – 247EmiratesGuides.com