Advertisements

With this tutorial, you will learn how to manage your finances with Lulu Balance Check, making financial management simple and enjoyable. Whether you’re curious about salary deposits or keen on staying on top of your transactions, our step-by-step approach ensures you’re in full command of your financial affairs.

In this article, we have described the seamless convenience of effortlessly tracking your finances in just a few simple steps through Lulu Exchange Salary Card Balance Check.

Advertisements

Advertisements

Lulu Exchange Salary Card Balance Check Online

Advertisements

What is a Lulu Exchange Salary Card?

A ‘Lulu Exchange Salary Card‘ is a financial tool provided by Lulu Exchange, designed to facilitate employee salary disbursement. Much like a debit card, it allows individuals to access salary funds easily. These cards typically come with features such as purchases, cash withdrawals, and managing transactions.

This salary card has various options to check your balance and manage your finances. You can visit the official Lulu Exchange website and log in with your credentials. After that, you can view your current balance as well as previous transactions. Moreover, you can also avail of additional features offered by this exchange. The services include currency exchange, Lulu Gold cards, import and export of currencies, and more.

Advertisements

Lulu International Exchange Salary Check

Advertisements

There are three ways to perform a Lulu Balance Enquiry. These include visiting the website, using the mobile app, checking your salary by SMS, and visiting a branch. We will discuss each one in detail.

Lulu Exchange Website

- Visit the official Lulu Exchange website and log in using your account credentials.

- After you log in, click on “My cards” or a similar option and select the Lulu salary card to view your balance.

- Customers most frequently use this online method to check their Lulu Bank balance. You can view your account balance using an internet connection and from anywhere. Apart from this, this option also allows additional features such as bank alerts, transaction history, and spending analysis. As a result, you will have a better understanding of your finances.

Mobile App

- Download and install the Lulu Mobile App which is available on both Android and iOS platforms.

- Log in by entering your Lulu Exchange username and password.

- On the homepage, tap on “My cards” and select your active Lulu salary card.

- The app will display your current account balance.

- You can also view your transaction history and deposits. By doing this, you will be able to keep track of your expenses.

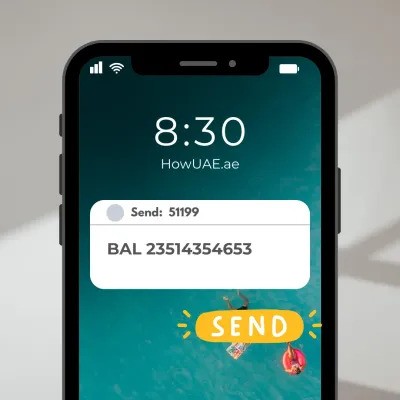

SMS Balance Check

The following are the steps through which you can perform a Lulu Balance Enquiry by SMS.

- Open your mobile phone and open your message.

- In the text section, type “BAL” (space) “NIN Number”.

- Send this SMS to 51199.

- You will receive an SMS notification of your current balance.

The SMS balance check number i.e. 51199 is for users in the UAE. If you are not a UAE resident, you will need to send this SMS using the Lulu Exchange number provided. The Lulu Salary Check SMS is convenient and easily accessible allowing users to keep track of their salary card balance from anywhere.

Visit a Branch

You can visit any Lulu International Exchange branch for a salary card balance check. Here are some reasons why you should visit a branch.

- Face-to-Face Assistance: Visiting a bank branch allows customers to interact directly with the staff, obtaining personalized assistance and clarification for any queries.

- In-Depth Financial Discussions: Customers can have detailed discussions about their financial needs, goals, and potential services, receiving tailored advice for their specific situation.

- Transaction Support: For complex transactions, visiting a bank branch provides a more secure environment with staff assistance, ensuring accuracy and addressing any concerns promptly.

- Access to Additional Services: Customers can explore and sign up for a variety of financial products and services available at the branch. Investment options, or specialized accounts, fall into this category.

Lulu Salary Card Financial and Personal Information Security

Lulu Exchange safeguards personal and financial data with a comprehensive array of security measures.

- Strong Passwords, Your First Line of Defense: Lulu is all about empowering its customers. Start by creating a strong password for your account – an effective defense against unwanted visitors.

- Security checkups: This company does not just set it up and then forget it. Regularly checking and fine-tuning its security game is its mission. In a way, it’s like a regular checkup for the peace of mind of its customers.

- Multi-Factor Authentication for Added Safety: With multi-factor authentication, you’re not just relying on a password – it’s a double-check using things you know and things you have, like your trusty mobile sidekick.

- Data Protection, Fort Knox Style: Your data is royalty to the company. They wrap it up in encryption, making it an impervious fortress – safe from prying eyes as it zips through the internet.

- Transaction Vigilance in Real-Time: The system keeps a watchful eye on every transaction. If something seems off, they’ll take care of it in a flash, ensuring your financial world stays squeaky clean.

- Privacy First, Always: The organization doesn’t just talk about it. Its stringent privacy policies are more like personal oaths. Lulu Exchange dances to the regulatory tune, ensuring its customers’ information is handled with the utmost care and respect.

Keeping these security measures in mind, it is evident that Lulu International Exchange salary check is quite secure. As a user, you do not have to worry about someone breaching your account or accessing your information.

Lulu’s Online Balance Check Features

You can manage your finances with Lulu’s online balance check, where convenience takes center stage. Here are the key features that make checking your balance a breeze:

- Instant Access Anytime, Anywhere: Your financial information is just a tap away, ensuring you can check your balance at any moment, from any corner of the internet.

- User-Friendly Vibes: You can navigate effortlessly through the interface, making checking your balance a walk in the park, even for those not well-versed in online platforms.

- Real-Time Updates – Stay in the Know: Enjoy real-time updates, with your account status and transactions at your fingertips whenever you need them.

- Security on Lockdown – Your Data is VIP: Your financial details are treated like royalty, protected by robust security measures and top-notch encryption.

- Past Meets Present – Transaction History Magic: Check your financial past transactions, gaining insights into your transaction history whenever you fancy a trip down memory lane.

- Your Devices, Your Rules – Access Anywhere: Whether you prefer a laptop, tablet, or smartphone, enjoy the flexibility of managing your money on your device of choice.

Advertisements

FAQs

Advertisements

How to check balance on Lulu card?

You can make a Lulu Bank Balance Check in either of the following ways:

- Website: Visit the Lulu Exchange website and log in to your account. Click on “My Account” and the system will display your current balance.

- App: Download and install the Lulu App on your mobile device and log in to it. It will display your balance on the homepage.

- SMS: Type an SMS in the message, write ‘BAL’, and send it to 51199 (UAE only).

Can I use the SMS Balance Check Method to check the balance of my salary card issued by another bank?

You can check the balance of your salary card issued by another bank through the SMS balance check method. It is a very convenient and hassle-free approach and you can do so from anywhere.

Is it possible to check my salary card balance using a third-party app?

You can check your card balance using a third-party app. To do so, simply download and install the app and log in with your account credentials. View your balance by accessing the section dedicated to it.

Can I use the Lulu Exchange Mobile App to transfer funds from my salary card to another bank account?

You can transfer funds through the Lulu Exchange Mobile App from your salary card to another bank account. This app offers various features such as currency exchanges, funds transfers, and bill payments.

Are there any fees associated with checking my salary card balance online?

There is no fee associated with checking your salary card balance online. Using this service is free of charge, so you can check as many times as you like.

Also check out: FAB Balance Check Online 2025 | First Abu Dhabi Bank

Also check out: NBAD Balance Inquiry | Online Salary Check Ratibi Card

Also check out: RTA NOL Card Balance Check with Number Online | Complete Guide

Advertisements

Everything About Jobs in Gulf – 247EmiratesGuides.com

Everything About Jobs in Gulf – 247EmiratesGuides.com